modified business tax nevada due date

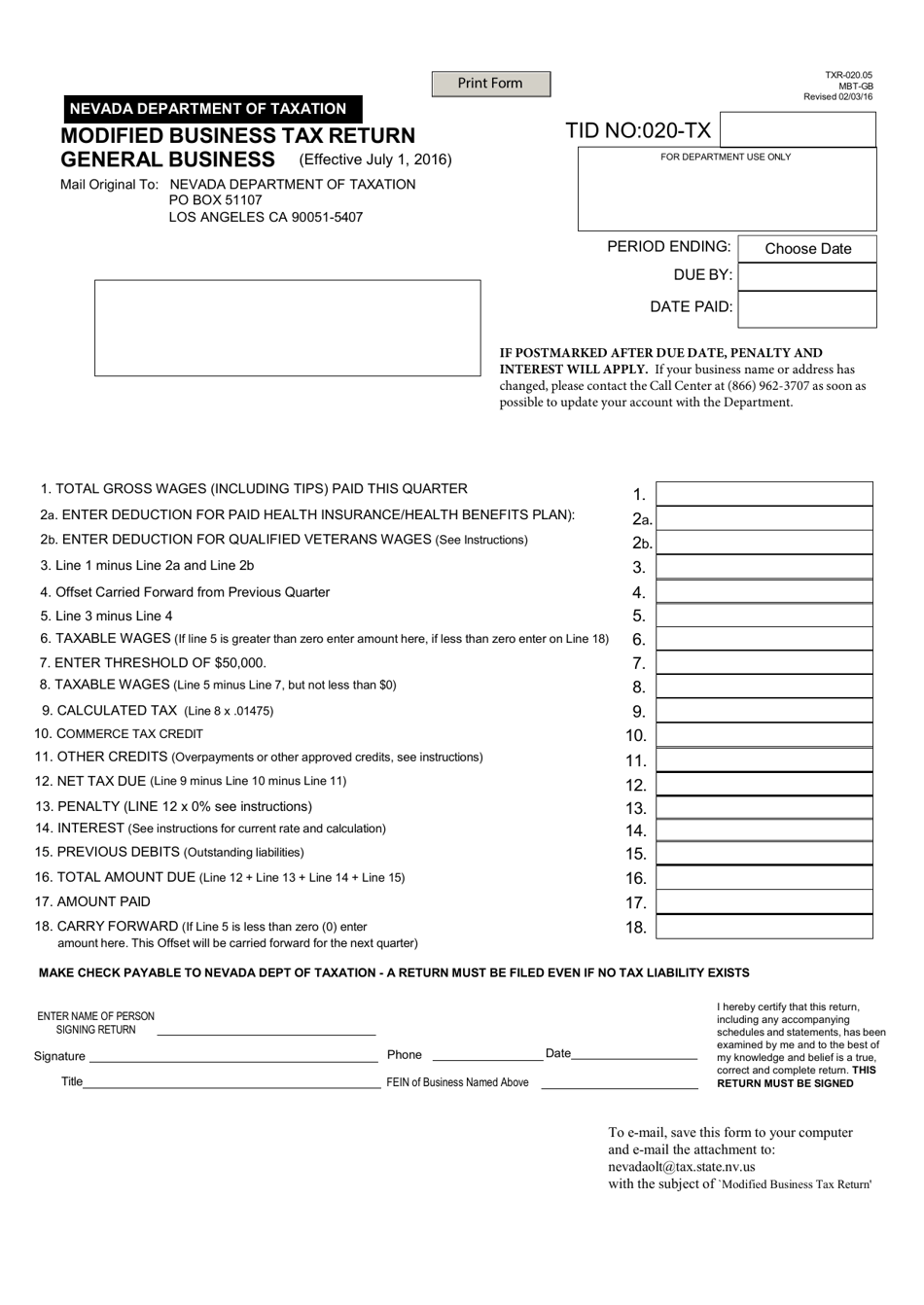

If you own a business you may be wondering if you need to file a Modified Business Tax Form. This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the tax on the Net Proceeds of Minerals imposed pursuant to.

The Nevada Department of Taxation has successfully sent out its first round of Modified Business Tax refunds to 22621 business.

. The Nevada Modified Business Tax is a tax on business gross receipts. Get Your Business Tax DMV Fee Refunds. The Nevada Department of Taxation DOT is.

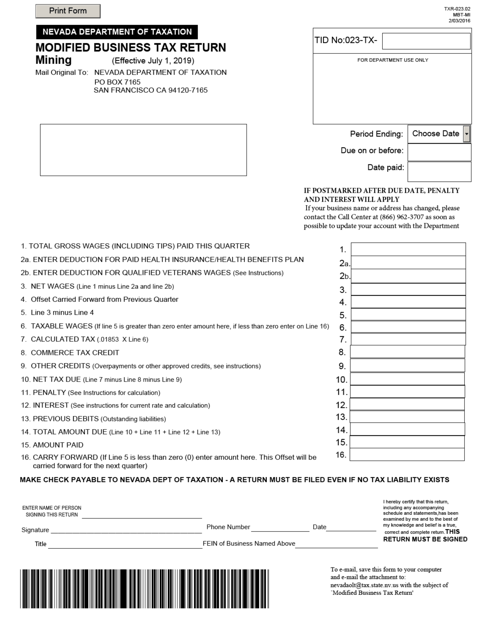

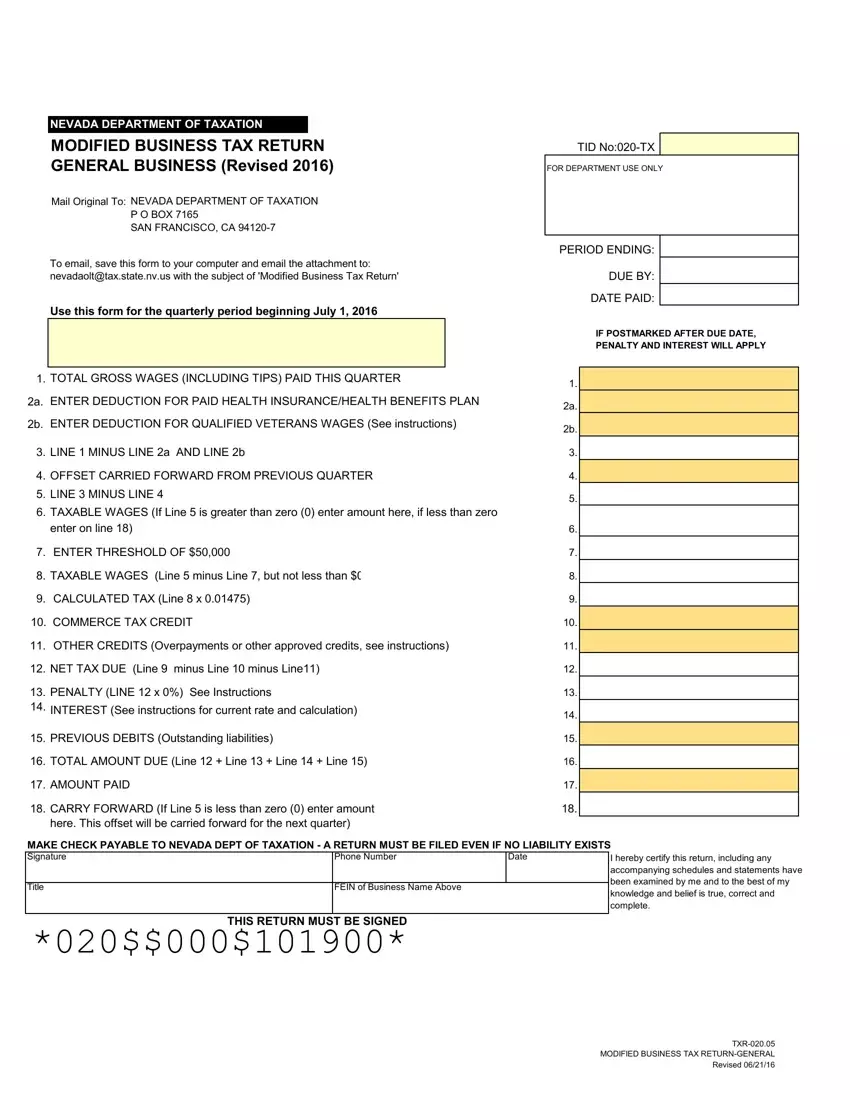

Q2 Apr - Jun July 31. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019. Q1 Jan - Mar April 30.

The amount of penalty that should be entered. The tax rate is 005 for. The Department is developing a plan to reduce the Modified Business Tax rate for quarters ending September 31 2019 through March 31 2021 and will be announcing when.

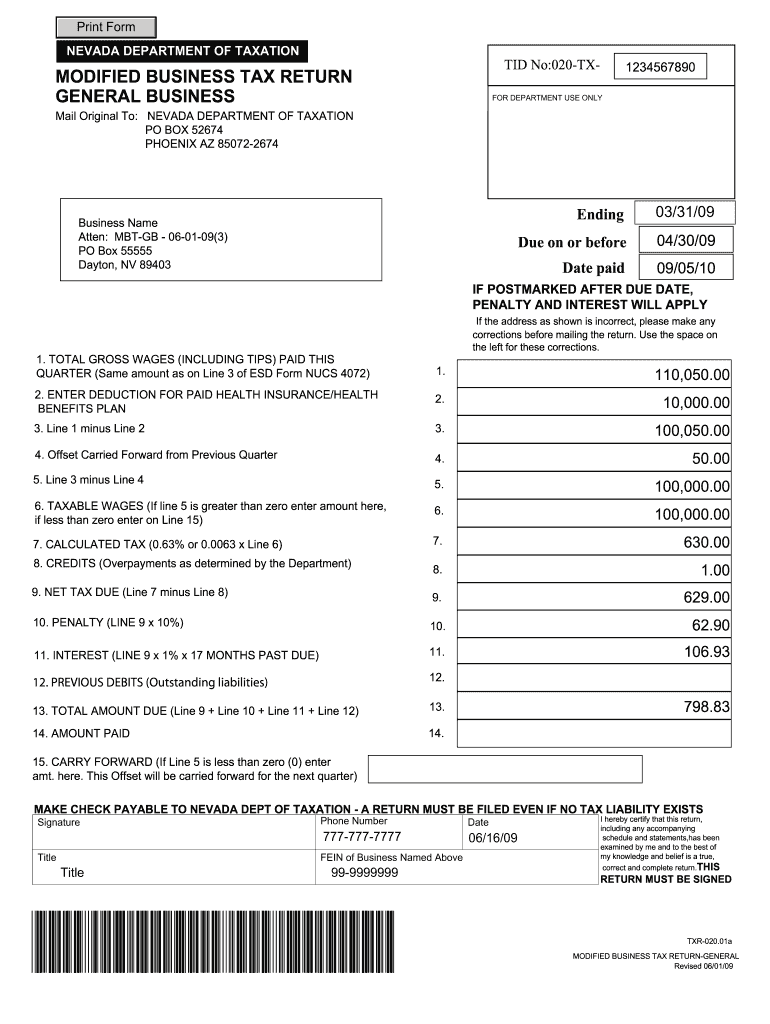

For example the taxes were due January 31 but not paid until February 15. Nevada Tax Form Modified Details. Under the sunset in.

Tax for each calendar quarter is due on the last day of the quarter and is to be paid on or before the last day of the month following the quarter. When is the tax due. This two-tiered tax rate structure was scheduled to be effective for FY 2012 and FY 2013 only due to the June 30 2013 sunset in AB.

The 31st Special Session of the Nevada Legislature enacted Senate Bill 3 which provides for a one-time tax amnesty program for businesses or individuals doing business in. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019. 12 rows Due Date Extended Due Date.

The default dates for submission are April 30 July 31 October 31 and January 31. Businesses that have gross receipts of 4000000 or more per year are subject to the tax. Nevada modified business tax due dates by Jan 24 2021 cartoon concept science The 2011 Legislative Session pursuant to AB 561 eliminated the Modified Business Tax on any General.

Exceeding 62500 per quarter. If your company paid Nevada Commerce Tax and has its payroll concentrated outside Nevada it should consider filing a refund claim for the tax year ended June 2019 by the. This form is for businesses with income over 1 million.

Forms and payments must be mailed to the address below. The number of days late is 15 so the penalty is 4.

What Is The Business Tax Rate In Nevada

How To File And Pay Sales Tax In Nevada Taxvalet

Nevada Taxes Will The Tax Man Cometh To Carson City In 2023 Nbm

Nevada Commerce Tax What You Need To Know Sage International Inc

Nevada Mbt Fill Online Printable Fillable Blank Pdffiller

Nevada Department Of Taxation Forms Pdf Templates Download Fill And Print For Free Templateroller

Modified Business Tax Form Fill Out Printable Pdf Forms Online

Nevada Department Of Taxation Forms Pdf Templates Download Fill And Print For Free Templateroller

Form Txr 020 05 Download Fillable Pdf Or Fill Online Modified Business Tax Return General Business Nevada Templateroller

How To File And Pay Sales Tax In Nevada Taxvalet